Lead Consultant at Domain 6 Inc.

As a part of period end, accounting conventions require that Accounts payable, Accounts Receivable, and GL balances in foreign currency are revalued. Along with the AP, AR and GL balances accounting conventions require revaluing the bank balances in foreign currency. In this article, I would like to show you how easy the process for bank foreign currency revaluation is in Microsoft Dynamics 365 Finance.

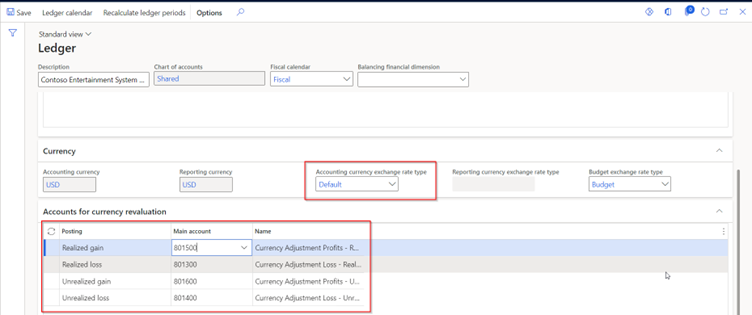

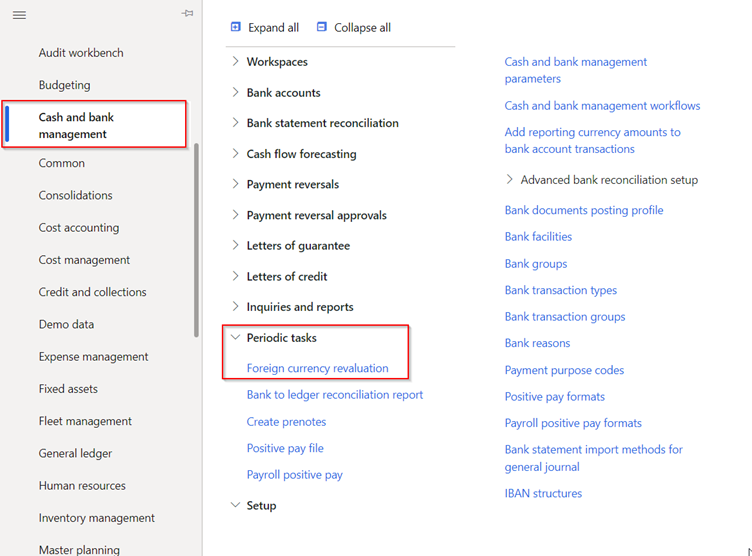

Here are the setups that are required to run the bank foreign currency revaluation:

You must enable “Enable bank revaluation without a parameter” in the Feature management workspace as shown below to see the foreign currency revaluation menu item.

2. Click on Foreign currency revaluation on the action pane to open the bank foreign currency revaluation dialog box. Following fields are required to fill for revaluation process

3. You can run the bank revaluation process for one or more legal entities, but the user can see only the legal entities that he/she has access to.

4. System will display all the bank accounts that are eligible for foreign currency revaluation. You need to select the bank for revaluation from the list provided.

5. Enable Preview before posting option to Yes to view the results before you post it.

6. Select Ok to process the foreign currency revaluation.

In Cash and bank management, System will consider the balance of the bank account in accounting currency, and it will revalue the balance based on the exchange rate set up on the foreign currency revaluation dialog box.

For example: Accounting currency is USD and you have created bank account in EUR and posted EUR 10000 receipt at exchange rate of 0.72 on July 15th 2022. The balance in accounting currency is $7200. On 31st July 2022 your accounting team has updated the exchange rate to 0.75 and the new accounting balance of the bank is $7500. If you run foreign currency revaluation on 31st July 2022 system would post $300 to unrealized gain account.

If you want to reverse the posted foreign currency revaluation, please go to the Reverse Transaction on the action pane and provide the date of reversal as shown below and click OK.

As you can see, the process of bank foreign currency revaluation in Dynamics 365 Finance is an easy process, enabling your finance team to save time and effort while staying compliant. In case you have any questions left, please feel free to reach out to us here.